It is common to quote the statistics that the top 1% of wage earners pay 38% of the Federal Income Tax collected, or that the top 10% pay 70% of the taxes collected. But these statistics, as seemingly outrageous as they are, actually grossly understate the real situation. When talking about 1% of the population, they should be compared to other 1% segments, not to the remaining 99% as a whole. For example, let's say Jane makes $1M a year, but has 99 workers earning $40K a year. The total wages for all 100 workers is $4.96M. It is nonsensical to say that Jane makes only 20% of what the other employees make. But this is exactly what is being done above when one states that “the top 1% of wage earners pay 38% of the tax.” Instead, one generally correctly states that Jane earns 25 times more than the average employee. We get envious when we learn Jane makes 25 times more than we do, but it is not at all distressing to be told instead that she makes 20% of what we make.

So with the tax burden, the question one must ask is, “What do the top wage earners pay in taxes in relation to other groups of the same size?”, or, "How much more does a top wage earner pay on average than any other wage earner?"

For example, compare the top 1% of wage earners to the 99 other groups containing 1% of wage earners. The top 1% pays 38% of all federal income taxes, while the other 99 groups pay, on average, only 0.63% of the taxes each (62%/99 = .63%). Thus, the top 1% of wage earners pay 60 times more in taxes than their average counterparts in any other group including 1% of wage earners (38/.63 = 60). This means that each member of the top 1% group pays, on average, 60 times more in taxes than any member in any other 1% group. If this were income, and the average member of the other 99 groups earned $27K per year (they do), then the average pay in the top 1% group would be $1.6M (it isn’t - it is, in fact, $380K).

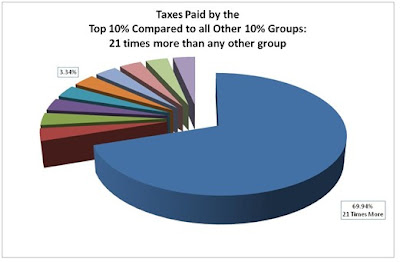

The charts below demonstrate graphically how much the top 1%, 5% and 10% of wage earners pay in relation to other groups of the same size. The top 1% of wage earners pays 60 times more in taxes than any other 1% group. Stated differently: The top 1% of wage earners pays 6,000% more in taxes than any other 1% group. So with Jane, we weren't upset when we heard she made 20% of what we make. But when we learned she actually makes 25 times more than us, we got interested. Likewise, it might not sound so bad to learn that top wage earners pay 38% of all taxes. But isn't it another story when we learn they pay 6,000% more than we do?

One must then ask: "If paying 6,000% more than any other group of tax payers is not a fair share, then what is?"

No comments:

Post a Comment